Breaking Even

Lee Peters | 3 December 2013

Finding your minimum ‘ticket to play’…

Exactly how profitable are the different departments in your dealership? How much must be sold to cover the costs every month? What happens if those costs or prices change?

In the current market, where margins are under increasing pressure, understanding departmental break-even points is a crucial part of making solid business decisions.

In fact, best practice dealers ensure that their staff understands how much each department needs to sell in order to trade profitably. Reaching that break-even point is then celebrated as a key milestone that the team is focused on each month.

What is break-even?

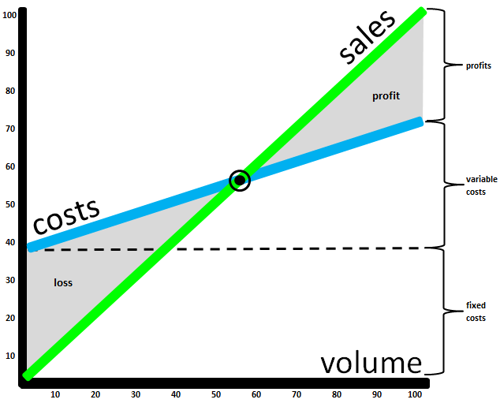

Put simply, break-even is the point at which total income from sales equals total expenses.

Break-even is used to answer questions such as: What is the minimum level of sales needed to ensure there is not a financial loss? How sensitive is the break-even sales volume to changes in costs or price?

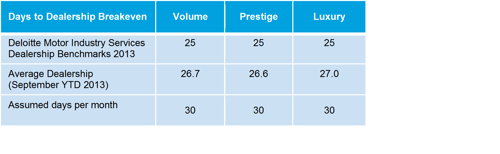

Interestingly, and perhaps worryingly, the average Australian dealership in the ProfitFocus database only starts to turn a profit after trading for 26 to 27 days each month (as per the below table). Even the best operators take until the 25th day of the month to cover their costs.

Communicating this across the business is a tangible way for staff to understand just how tight the operating margins are in a car dealership.

There are several elements that need to be understood to determine the break-even point of an operation. These include the costs of the department or business (both fixed & variable), the revenues, and - especially - the contribution margin for the department (i.e. gross profit less variable costs).

Calculating break-even

Break-even sales can be determined using the following formula:

BE Sales ($) = Fixed Costs

(Contribution Margin % / Total Sales per unit)

Once you have determined the break-even sales in dollars, this can be converted to the number of units that need to be sold - be that new or used unit vehicle sales, parts and accessory items, finance contracts, or labour hour units - in order to breakeven.

Understanding your costs

Categorizing operating costs between fixed (including semi-fixed) and variable costs is essential in conducting a break-even analysis.

Fixed costs are those which are not directly related to the volume of production. They are often referred to as “overhead” costs and do not change as departmental sales volume or production changes in the short run. These costs will still exist even if production or sales stop. Fixed costs in a dealership generally include administrative costs and salaried personnel costs, rental costs, interest charges, depreciation, insurance and property taxes as well as departmental ‘semi-fixed’ expenses such as advertising and training (which generally cannot just be completely ‘switched off’ at a moment’s notice).

Variable costs, on the other hand, are those that change as production output or sales volume changes. Variable costs include wages for service labor, salesperson commissions, pre-delivery costs and freight charges.

How to reduce your break-even point?

Businesses can reduce their break-even point by reducing the amount of fixed costs. Having fewer fixed costs means that fewer sales will be required to cover them. Some possible ways to do this include:

- Rationalising the dealership footprint (lowering rental costs)

- Taking the administration department to the ‘Cloud’

- Selling more (and marketing more) through online channels (to reduce the physical infrastructure needed to support those sales)

- Comparing staff effectiveness and efficiency to industry benchmarks, and building the staffing structure accordingly

Alternatively, the break-even point can be reduced by increasing the contribution margin earned from each unit sold. The contribution margin can be increased by a reduction in variable costs per unit.

Some possible ways to do this include:

- Revisiting and resetting commission structures

- Bringing pre-delivery centres on-site

- Decreasing the amount of unapplied time in the service department

Finally, the contribution margin will also increase if the operation is able to increase its selling prices, and pushing to make sure that the additional revenue flows into the gross pool; unit-by-unit, contract-by-contract, customer-by-customer.

In practice, the best approach is likely to be a combination of reduced fixed costs, reduced variable costs, and slight increases in prices. It should at least be the goal.

Sensitivity analysis

After the break-even point has been determined, it is then possible to evaluate a number of different scenarios using the calculation. This is often referred to as a sensitivity analysis and allows you to ask, and evaluate, a number of “what if” questions.

For example, what would happen to dealership profitability if new car gross levels increased by $250 per car? 5% more sales were converted to finance customers? Technician efficiency improves by 5%? The used car team sells 2 more used vehicles per month per head of staff? It can also be a useful exercise to ask what would happen if things take a downturn: what happens if new car gross falls by $200 per unit? If parts revenue declines by 10%?

To find out more about dealership break even statistics or our sensitivity analysis tools please feel free to contact our Deloitte Motor Industry Services team.

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.