Update on Flex Commission

5 October 2017

Executive Summary:

On 5th September 2017, ASIC released a draft of a proposed legislation with regards to flexible credit cost arrangements. The motor dealerships in Australia need to prepare their businesses to adapt to the changes as currently approximately 80% of their profitability is dependent on finance income

To successfully navigate these changes the dealerships may need to consider the following:

1. Increase Finance department productivity & penetration by re-engineering all sales processes

2. Protect where possible, the retail gross on new and used vehicles

3. Manage the variable and semi fixed expenses in the new and used department, set targets and commissions using scientific principles

This update and a detailed paper published on eprofitfocus.com.au, helps the reader understand how the Auto retail industry in Australia may be affected and how it can successfully adapt to these changes.

Background:

On 5th September 2017, ASIC has released a draft of changes to the National Consumer Credit Protection Act 2009, which will be effective 1st Nov 2018.

What does this legislation do?

- It prohibits the payment of flex-commissions

- Provides for a limited exception to the prohibition that allows lower commissions to be paid where the price of credit reduces.

- Addresses the risk of avoidance by casting the prohibition in broad terms

Following is a quick summary of some of the issues this change brings to the Auto retail industry and some high level remedies that you can look at:

Issue 1. Finance Income may reduce.

Today approximately 80% of dealer profitability is dependent on finance income. With the recent proposed legislation on flex commissions, dealers' ability to generate income from finance operations will be constrained.

Areas to consider:

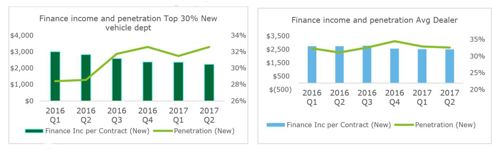

To potentially decrease this impact on profitability the dealerships need to increase Finance department productivity and finance penetration. Along with looking at these core areas, the dealerships also need to protect the per unit grosses on new and used vehicle, wherever possible. Figure 1: below shows how the top dealers are already adapting to this change by increasing their penetration levels as opposed to the average dealers.

Figure 1: Finance income per contract and new vehicle finance penetration Top 30% (new vehicle dept) ve Average dealer

Issue 2. Some of the current sales processes in the average dealership are not very efficient and rely on multiple handovers from sales person to finance personnel etc. as a result the current penetration levels are around 34% to 35%.

The current sales processes were built with focus on department specialists. This introduces an element of detachment where the customer may not be the focus throughout, and lasting customer relationships may not form.

Areas to consider:

The dealerships can leverage the current changes to design a better sales process where the handovers are less, and the process is more customer focused. The specialised role of a business manager can be simplified for an early introduction of the finance element in the sales process. The dealerships may need to train and qualify the sales person to also sell finance.

Issue 3. Recent actions by ASIC and the ACCC raises the perception that dealerships are not customer friendly and are perceived as solely profit driven organisations.

The recent scrutiny by the regulating authorities on Flex commissions and add on insurance, along with falling service retention levels, point towards an atmosphere of trust erosion where the dealerships are not perceived as the champions of customers. This image crisis, if not tackled right away, has a potential to affect business in the long run.

Areas to consider:

The dealerships need to assess if their systems and processes are customer focused or are solely profit driven. The dealerships may have to consider the way they engage customers and also assess the products they sell. For example, with reduced insurance commissions, is it still financially viable to offer these products or should you offer these products purely as customer convenience?

These are some of the issues that the industry needs to address, but with less than 12 months to the regulation change, we recommend that at a minimum you should

- Understand the new regulation

- Analyze and quantify the impact of this change on your dealership or network

- Identify areas of opportunity in your sales process

If you wish to access the F&I regulatory impact for your brand / state segment grouping and understand how you can gain more from our benchmarking and analytical capabilities we would be pleased to discuss the results of our analysis with you.

Contacts:

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.