Are you getting your fair share of used vehicle sales?

Deloitte Motor Industry Services | 2 July 2013

Following last month’s article on the financial dynamics of used cars we were contacted by a number of dealers interested to know more.

On the back of this popularity, we would like to share the findings and conclusions from a recent analysis we conducted on the used vehicle market in Australia.

One of the most prominent debates in used vehicle operations that we have observed over the last couple of years has been the trade-off between Gross Profit and Stock Turnover.

Since the global financial crisis, there has been a movement to treat all cars as commodities and for dealers to be more willing to accept a smaller gross profit margin on every unit sold.

As a result of this change in perception, as well as other factors, such as the growth of internet sales platforms such as carsales.com.au, there has been a decline in the percentage of used vehicles retailed by franchises dealers.

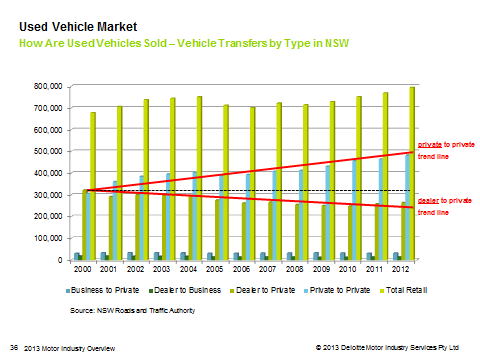

As the below chart demonstrates, approximately 50% of all used vehicle retail sales in NSW were dealer-to-private sales in 2000. In 2012, this percentage has fallen to approximately 33%. This is despite the overall size of the total used vehicle retail market increasing over this period.

Whilst there are a number of differences between the states, we expect NSW to be representative of Australia as a whole and for this trend to be experienced by the majority of dealers.

What does this mean for dealers?

Have you ever run into a used car specialist buyer (Australian Fleet Sales for example) at an auction? You’ll notice that on certain units, the used car specialist buyer will consistently outbid the franchise stores. Why? Because they know which cars are valued higher by customers.

To that end, CarMax (a listed used vehicle specialist in the USA) published a study recently that revealed 77% of consumers rank value (typically tied to some aspect of quality) over price as their primary buying criteria. In your own dealership, why would you blindly adopt a pricing strategy that is only focused on 23% of the market? How much money are you potentially leaving on the table? Benchmark dealers incorporate best practices in Used Vehicle Retailing to maximise both gross profit and stock turnover.

These benchmark dealers typically focus on four key areas every month:

1. Visibility

Having the ability to quickly go from a 30,000-metre view to a very granular level in the blink of an eye. Whether benchmarking and managing performance at the group level or managing at a single site, it is essential to have deep visibility into areas like:

- appraisal closing

- missed trade opportunities

- inventory aging

- value pricing

- stocking

- online performance

You need to have access to sales data that allows the dealer principal and site general manager to see and compare gross profit margins, stock turn levels and opportunities across all sites, with a focus on their retail sales efficiency (sales within 60 days).

2. Best Mix

The best used vehicle retailers are able to determine the best mix of inventory for their unique site and prime market area (PMA). Then they execute highly innovative practices to source that inventory.

3. Dynamic Pricing

Rather than ‘starting every car at 110 percent of market,’ benchmark used vehicle operators have adopted a value pricing mindset to maximise the gross profit potential of every car. This means utilising the tools at their disposal to determine the difference between the high margin and low margin cars on their yard, and pricing them accordingly.

4. Online Merchandising

With hundreds of thousands of used vehicle advertisements online at any one time the need to stand out from the crowd has never been greater. This requires utilising content that resonates and is highly relevant to the buyer. Sell the value of the vehicle in your advertisement.

Conclusion

In today’s highly competitive used car market it is still possible to achieve both a solid gross profit margin as well as efficient stock turnover. Dealers who only focus on one or the other are leaving potential gross profit on the table and are not gaining their fair share of used vehicle sales.

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.