Industry Stock Level

Dorian Lapthorne | 16 October 2013

A push market

Deloitte Motor Industry Services has been highlighting for most of this year that the current market for new vehicles appears to be a “push market” – that is, a market in which the supply factors in the market are having a greater impact than the demand factors.

To put it another way, global manufacturers have been looking at the Australian market as a bright spot on the world stage and have decided that it is better for them to push an extra slice of their production here – even if those extra cars require heavy retail marketing support when they get here – than it is for them to slow down the line speeds in their factories.

Dealers have clearly benefited from this, with the net profit return on sales for the average dealer in the ProfitFocus database over the last 18-24 months in excess of 2% - well above the average of 1.0% - 1.5% that we typically saw between 1996 and 2011 (the unusual conditions of the Global Financial Crisis excluded!)

However over the last 9 - 12 months, even though new car volumes have continued to climb, there have been signs that dealer profitability is starting to soften. In our last Motor Industry Alert we pointed out that the volume: gross equation in the new car department had started to soften for the average dealer in Australia and the increases in revenue from Finance & Insurance were no longer enough to offset this.

The result has been that net profit for the average dealer in the ProfitFocus database has begun to move back down towards the long-term average of 1.5% return on sales - with July month at 1.6% and August month at 1.4%

What about stock?

A question to be asked in this environment is what is happening to new car stock?

The push environment certainly seems to be driving sales of new cars, but is this having an impact on the stockholding in dealerships? Are the extra units which are going out the front door lowering the stock being held by dealers, or does the push market mean that – despite selling more cars - dealers are actually carrying more stock?

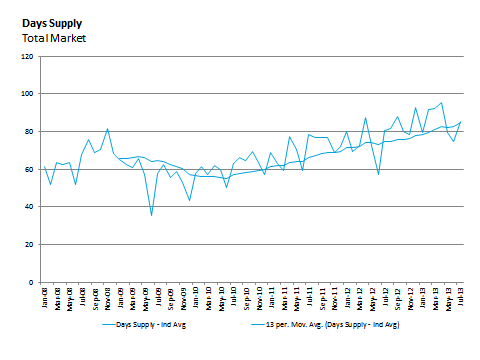

To answer this question it is important to look beyond the absolute number of units of stock held and look at the Days Supply being held (i.e. the units of stock held by a dealer at the end of a month divided by the average number of units that dealer sold each day of the month).

Looking back at the ProfitFocus database over the last five years shows that stock levels for the average dealer across the total industry declined in 2009 in the aftermath of the global financial crisis and remained at relatively low levels – around 55 to 60 days for the average dealer - during 2010, before beginning to creep back up to 60 – 70 days during 2011.

Since 2011, the level of New Vehicle Days Supply for the average dealer has continued to lift at a rate of approximately 10 days per year to be in the range of 70 – 80 days through 2012, and 80 - 85 days in the first half of 2013.

However, during this time, dealers in the three market segments – Volume, Prestige and Luxury - experienced somewhat different situations.

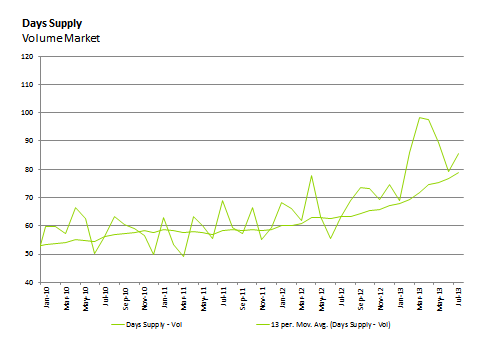

Volume Market

The average dealer in the Volume Market started 2012 with somewhere around 60 days supply of new cars. Then, even though 2012 saw record new car volumes and increasing dealer through-put, stock on hand for the average Volume Market dealer continued to climb until, by the end of 2012, the they were carrying over 65 days supply.

During the first half of 2013 this rise continued and even accelerated to reach 75 – 80 days of new vehicle stock for the average Volume dealer by July 2013.

This represents an increase of 15 - 20 days’ supply in the last 18 months, in an environment when new car sales volumes also increased strongly.

Across the Volume Segment as a whole, the Top 30% most profitable new car operators were carrying around 9 days less stock than the average dealer by July 2013.

That is not to say that the stock levels of the top performers did not grow over this period, they did, but these operators managed to keep that growth at a lower rate than the average operator.

For example, while the stock holding of the average dealer grew by over 10 days between July 2012 and July 2013, the stock of top operators only grew by around 5 days over the same period.

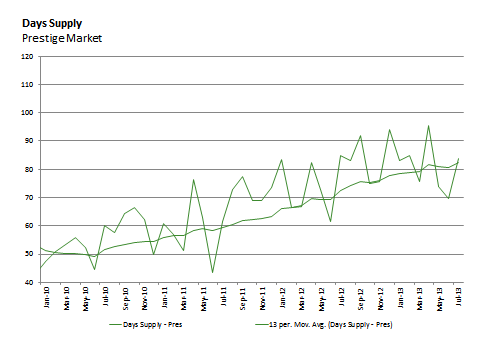

Prestige Market

The average Prestige Market dealer has had a similar experience to the Volume Market dealer over the last 5 years, although the level of stock they carried has tended to be slightly higher than their Volume Market counterparts.

At the start of 2012, the Prestige Market dealers were carrying, on average, 65 days supply of new cars and by the end of that year they were already holding over 75 days – reaching that level of supply 6 months earlier than the dealers in Volume segment. Then, for the Prestige dealer, the growth in stock holding began to slow down during 2013 and now sits broadly at 80 days. This means that both the average Prestige and Volume dealers are currently holding about the same level of supply.

While the top performing new car operators in the Volume segment are holding about 9 days less stock than the average dealer, the top 30% most profitable new car dealers in the Prestige Market are holding roughly 14 days less supply than the average dealer in the segment and this has remained broadly the same over the last 12 months.

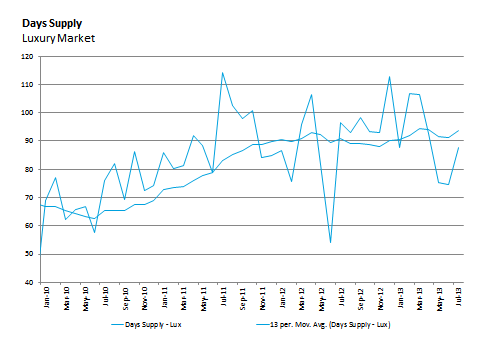

Luxury Market

As a general observation, dealers in the Luxury Market tend to carry a slightly higher level of stock than their Volume & Prestige counterparts.

The 2013 Deloitte Dealership Benchmark for Luxury dealers is 55 – 65 New Car Days Supply, compared to 50 – 60 days for a Prestige or Volume market dealer. Therefore it is probably not a surprise to see that, after the global financial crisis, stock began to climb more quickly for the average Luxury Market dealer than for any other.

By the start of 2012, these dealers were already carrying 90 days’ supply on average – and this peaked at around 95 days towards the middle of 2012 – before dropping back down to just under 90 days by the end of 2012. For the Luxury Market dealers, stock levels have again increased slightly during 2013 and are currently sitting around 95 days supply for the average dealer.

Therefore, the Luxury Market dealers have bucked the industry trend over the last 18 months and have increased their supply levels by just 5 days. Looking over a shorter timeframe they are holding roughly the same levels of stock as they were 12 months ago.

It is extremely interesting to note that in the Luxury Market segment, the most profitable new car operators carry almost the same level of stock as the average dealers in the segment. Across the dealers in the ProfitFocus database for 2013 the difference is only 3 days, and for more than one luxury brand, the top 30% of dealers are actually carrying more stock than the average dealer for that brand.

So the simple answer to the question about what is happening to dealer stock is that it is not so simple. While it is true that the average dealer in each segment is carrying more new car stock (in terms of Days Supply) than they were 18 to 24 months ago, the story is different when looking over the last 12 months. Volume and Prestige Market dealers are holding 10-15 more days supply than a year ago, while the average dealer in the Luxury Market is holding roughly the same level of supply as in the middle of 2013.

Implications for dealership profitability

There is a well-established link between stock levels and profitability in the new and used car departments. Holding stock incurs costs, in particular floor plan expenses, and therefore those dealers who hold more stock, all other things being equal, will incur more costs and therefore be less profitable.

However, this is a bit of a generalisation and ignores the many factors that go into determining profitability in the new car department. Indeed, when we move beyond the segment averages and drill down into the profitability of dealers by individual brands, it does not always hold true that those dealers with higher supply of new cars have lower levels of profit.

We have already noted that in the Luxury Segment there is almost no difference in stock holding between the top new car performers and the average dealer in the segment, but we also saw the same situation for certain brands across both the Volume Market and Prestige Market segments.

In the complex world of the new car department, some operators are finding ways to combine all the elements of volume, gross profit and costs that come together to make up new car profitability so that they can still deliver a superior result even with extra stock on hand.

Some of these dealers are carrying additional stock-holdings as a way of providing a benefit for customers. By having a greater breadth or depth of stock, they are able to supply the car their clients in short order, rather than the customers having to wait for an order to arrive. Some customers find this convenience a benefit worth paying for, and the dealers are able to use this to earn superior grosses – it also avoids the risk of the customer walking if they find the car they want elsewhere.

Other dealers are rigorous about the aging of the stock they have on hand, knowing that vehicles start to truly impact profit once they get old enough to move outside the various floorplan assistance programs provided by manufacturers and finance companies. Holding 110 units that are all within a free floorplan period is very different to holding 100 units of which 30 are old-stockers that have started incurring floorplan charges. Similarly, depending on the cost of finance for the dealership overall, paying out older vehicles on floorplan can be a commercially sensible option, although there is a risk that this will hide costs by transferring them out of the new car department and losing them in the general business cashflow.

In summary, while there is logically a link between stock levels and expenses in the new car department, there is more than one way to run a new car operation and it is overly simplistic to assume that more stock will always equal less profit. The trick is for dealers to find that combination of factors which is best for their customer base and their particular operations and actively work to that plan.

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.