Leading Indicators of Profitability II

Balram Dabhade | 17 May 2017

New Vehicle Gross

In this series, the second leading indicator we’d like to investigate is the contribution of the transactional new vehicle gross* to the business.

Over a period of time, new vehicle gross has come under pressure for Australian vehicle dealerships from increased competition, new model proliferation and changing incentive structures for achieving sales targets.

As we explore this KPI further and link it to others, we identified that the biggest contributor to gross reduction is excess and aged inventory. In the last article, we outlined the impact of new vehicle stock holding on dealer profitability (Link)

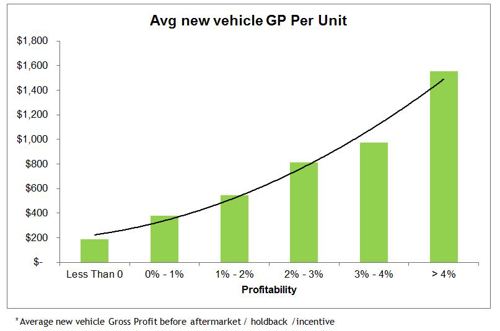

We studied over 1000 vehicle dealerships from our proprietary eProfitFocus database, selling different brands, from different segments across Australia over three years and observed that you could gauge the relative health of the business by measuring how much of the transactional new vehicle gross a dealership retained.

We studied how dealerships manage their new vehicle gross and how they drive the new vehicle department. From the data we evaluated, we noticed that new vehicle gross has a positive correlation with net profit for any given dealership.

As we did in our earlier study we segmented the industry into:

- Top30% dealers by NP%S,

- Average dealers and

- Loss making dealers

We noticed that the profitable dealers managed a well-balanced business and did not sacrifice the new vehicle gross. That means the profitable dealers focus on the core offering of new vehicle sales to get maximum gross profit from their core business while continuing to drive profit from bonus/incentive activity as well.

The net profit for the Australian vehicle dealerships studied, showed a positive correlation to the new vehicle gross and most of the dealers studied under this exercise showed an increase in net profit with an increase in the transactional new vehicle gross.

Conversely, the dealers whose net profit has been slipping from 2013–2015, showed a steady erosion of the new vehicle gross. Around 67% loss making dealers showed a decline in the new vehicle gross from 2013-2015.

Salient features to remember with respect to new vehicle gross considering our data:

- The top 30% dealers exhibit positive new vehicle gross and have good profitability

- Decline in new vehicle gross across a period may lead to negative / reduced profitability

- A leading contributor to reduction in new vehicle transactional gross profit is excess and aged inventory

As this leading Indicator series continues, we plan to continue to dive deeper into the data, to understand the factors that affect the profitability of vehicle dealerships across Australia further.

Stay tuned for more Leading Indicators in our next publications.

If you wish to know more about our benchmarking and analytical processes and how you can gain from these, we would be pleased to discuss the results of our analysis with you.

Contacts:

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.