Leading Indicators of Profitability III

Balram Dabhade | 16 May 2017

Finance and Insurance (F&I) Income

The third leading indicator, we’d like to investigate is the contribution of F&I income to the net profit of the business.

F&I has become an important aspect of any vehicle dealership in Australia, as it’s become a logical and profitable vertical integration.

We studied over 1000 vehicle dealerships from our proprietary eProfitFocus database, selling different brands, from different segments across Australia over three years and observed that you could gauge the relative health of the business by measuring how much the business relies on F&I income for profit.

From the data, we studied how dealerships manage their F&I income and how they drive the F&I department. We noticed from the data studied, that F&I can have a profound effect on your dealerships profitability.

As we did in our earlier study we segmented the industry into:

- Top30% dealers by NP%S,

- Average dealers and

- Loss making dealers

We noticed that the profitable dealers manage a well-balanced business and keep pursuing organic growth from the four core departments which are New, Used, Parts and Service Departments. This means that the profitable dealers focus on their core offering and get maximum profit from their core business yet also drive F&I activity as well.

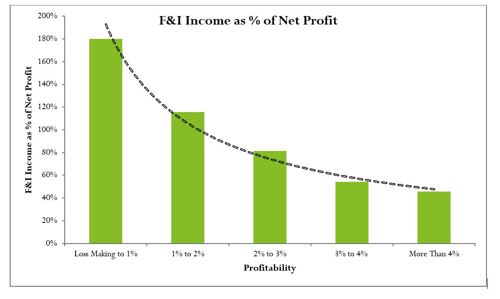

The data revealed that as the profitability of the dealers went up, F&I income as a percentage of Net Profits went down. In other words, the dependency of profitability on F&I income went down.

From this chart we can see that as the profitability of a dealership increases the contribution of F&I to the net profit shows a declining pattern. In other words the dealership is making sufficient profits from the core departments.

So as a percentage contribution the F&I income may look smaller in comparison, but in absolute dollar terms the profitable dealers get more income from the F&I Dept. as compared to their non-profitable counterparts.

To sum up this edition, here are a few things that we noticed from the data we studied:

- The Top 30% dealers make a profit in the core departments, and also earn more income from the F&I department than their counterparts

- The profitable dealers have better F&I penetration than the average dealers

- Excessive reliance on F&I income can signal a decline in profitability

We hope that you found the “Leading Indicator” series helpful, and if you wish to know more about how you can gain more from our benchmarking and analytical processes we would be pleased to discuss the results of our analysis with you.

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.