Used Vehicle Opportunity I

Balram Dabhade | 17 May 2015

The best dealerships usually distinguish themselves from the average by having well-balanced and profitable activities in the used vehicle sales, parts and service department.

In this report, we’ll examine the trends in the Australian market using the Deloitte eProfitFocus Motor Industry Reporting system, and gauge the indicators to better understand what an average vehicle dealer in Australia should do to better utilize the used vehicle opportunity.

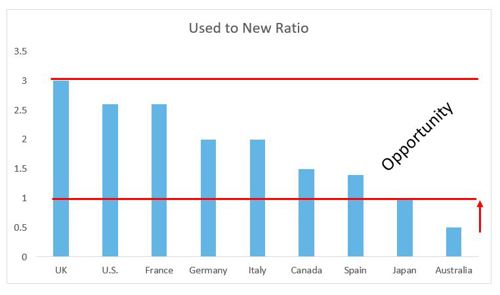

When we look at the Australian dealer market and compare ourselves globally we see that, it still has an opportunity to achieve its full potential in terms of used vehicles, and this becomes evident when we look at global used to new ratios in figure below.

Where the global dealer average for used to new ratio is 2.0, Australian dealer average is 0.5 as per the Deloitte eProfitFocus data.

Even if Australian industry meets the Japanese used to new ratio of 1.0 the industry will see a significant increase in the volume of used vehicle it sells.

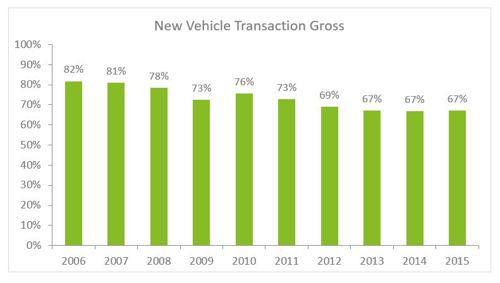

This point in time is important for the Australian industry, as in the hyper competitive environment, the new vehicle gross has started coming under pressure. If we see the new vehicle transactional gross we see a declining trend over a period of time as seen in the figure below.

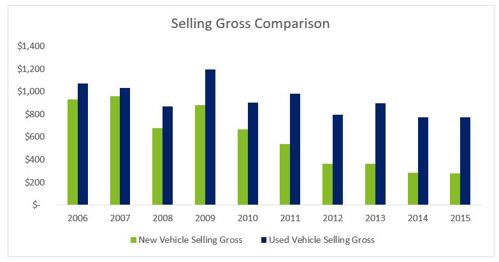

If we see the selling gross (retained margin) the picture becomes even clearer. Due to declining gross the dealers have less room to manoeuvre and their cost base to sell has remained the same or increased. As a result the selling gross in the new vehicle department has eroded significantly from almost $1000 per unit sold in 2006 to approx. $250 per unit sold in 2015 for an average dealer. If we see the used vehicle selling gross it is also showing the pressures and heading in the same direction.

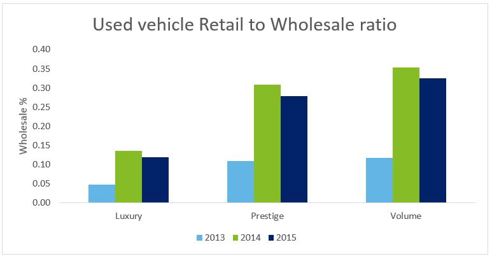

One way to reduce this dynamic shift from occurring would be for dealers to take back control of the used vehicle market. Remember every used vehicle starts somewhere as a new vehicle in a dealers yard. A key indicator to measure how effectively you’re performing on the used vehicle department is to look at your used vehicle retail to wholesale ratio. For the industry if we look across the different segments that Deloitte eProfitFocus tracks we are able to see a significant increase in the used vehicle retail to wholesale ratio over a period of years.

The figure below shows us that dealers are wholesaling more used vehicles in the recent years.

There are many factors influencing used vehicle performance. In this study going forward we will focus on what the best dealers in Australia are doing to retain the gross and selling gross in the used vehicle department. We will leverage the Deloitte eProfitFocus database and discuss how the Top 30% dealers optimize their used vehicle stock, what are their retail to wholesale ratios in the used vehicle department, how they ensure productivity and profitability.

If you wish to know more about how you can gain more from our benchmarking and analytical processes we would be pleased to discuss the results of our analysis with you.

Contacts:

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.