What caused the Quarter 3 2016 reduction in profitability

Balram Dabhade | 15 October 2016

The Australian motor industry is one economic barometer proxy for the Australian economy. They have both enjoyed healthy growth and have seen exponential growth complementing each other, the last quarter though was an exception to this story.

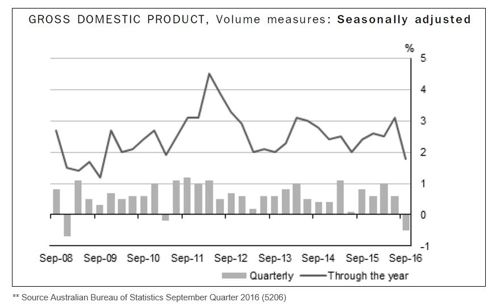

In Q3 2016 the Australian GDP (in seasonally adjusted volume measures) saw a negative growth of 0.5%, the largest quarterly decline since Q4 2008 and the first fall since the Queensland floods affected the GDP in March quarter 2011, and the motor industry saw one of the lowest quarterly profits in the last 5 years

Using the Deloitte eProfitFocus database of 1000+ dealers, we have analysed the profit reduction and share our insight in this paper.

This fall in GDP was driven by a few drivers such as slumping private investment in new dwellings, new engineering detracting and lower Infrastructure investment.

Vehicle sales and the Economy often are affected by the general consumer sentiment prevailing in the economy. This is because the purchase of a motor vehicle is one of the largest discretionary spends.

The June/July period was dominated by Federal elections and uncertainty. Consumer sentiment during this time and retail spending were hit. This resulted in decreased spending on new vehicles.*

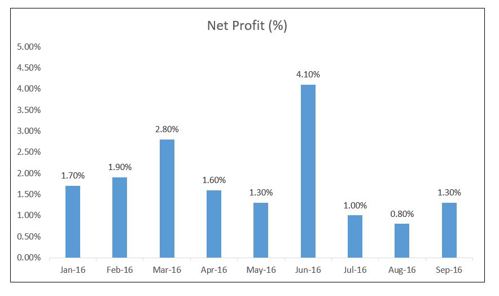

The motor industry weathered this and posted above average June sales but the declining consumer sentiment caught up with the industry in July and August 2016. The total dealership revenue declined by 3% and 4% in the months of July and August respectively from the half yearly average for the period Jan – June 2016 for Australia.

The chart below shows the NP%S for the Australian motor industry and we can see the months of July 2016 and August 2016 significantly lower than the other months causing the Qtr 3 profitability to dip in 2016.

We studied the Deloitte eProfitFocus database and here are some quick findings for the reduction in profitability for Qtr 3 2016 as compared to the period Jan – June 2016:

- Total dealership revenue decreased by 2.3%, with new vehicle revenue dipping by 4.9%

- The dealership gross eroded by 3.2%, this was a result of the new vehicle gross reducing by 14.9% and used vehicle gross reducing by 3.6%

- The new vehicle selling gross has seen a considerable reduction as it declined by 22% and the used vehicle selling gross declined by 12%

- The other income including other incentives saw a decline of 5.8% and

- The dealership fixed expenses in dollar terms have gone up by 5% in Qtr 3 2016 as compared to period Jan – June 2016

Following are the major KPIs we’ve seen change considerably in Qtr 3 2016, which has led to the impact on the dealership profitability:

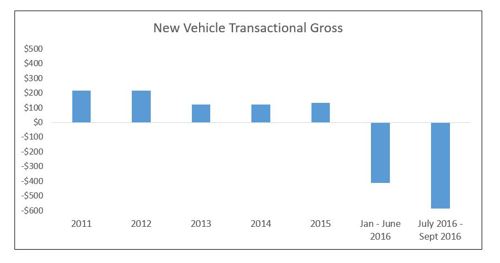

1. New Vehicle Transactional Gross: The new vehicle transactional gross over a period of time has seen a steady decline and was under pressure in 2016, in Qtr 3 2016 we’ve seen the lowest new vehicle transactional gross reported

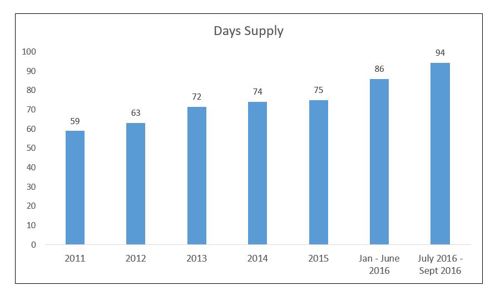

2. New Vehicle Days Supply: Vehicle inventory has been building up at the dealership levels. The days supply at a dealership level for new vehicle were at 94 days which is up 12 days on the Jan – June 2016 average.

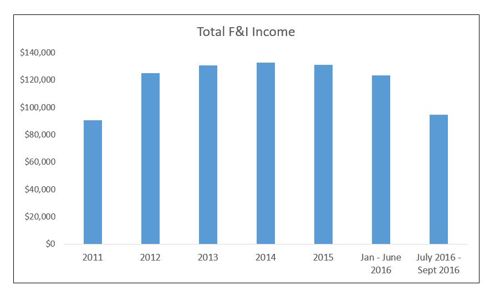

3. Total F&I Income: The total F&I income for Qtr 3 has declined by 23% as compared to Jan – June 2016. We’ve seen over recent years F&I income contributes over 90% of an average dealers profitability

If you wish to know more about how you can gain more from our benchmarking and analytical processes we would be pleased to discuss the results of our analysis with you

* Source - Global Markets research Economic Issues CAN 8th Dec 2016

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.