July 2015 Dealer Profitability

Deloitte Motor Industry Services | 27 August 2015

Total Industry

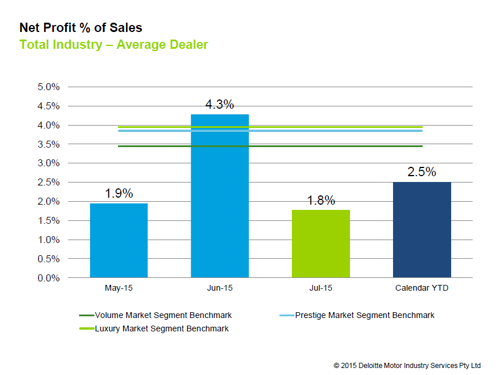

Dealer profitability as measured by net profit as a percentage of sales (NP%S) was 1.8% for the average Australian dealer in July 2015 and 2.5% for the calendar year-to-date (YTD). When comparing the July month result to the performance for the rest of the 2015 year so far, July saw lower new car profit profitability as well as other income contribution.

State-by-State

- The NSW/ACT state group returned an average dealer profitability result of 1.9% in July, with this being 0.7 percentage points above the July 2014 result. While total dealership gross margin was comparable between the years (at 12.4%), the increase in turnover and throughput for the average dealer in all departments has improved expense recovery and consequently underpinned the improvement in profitability. The calendar YTD NP%S for NSW/ACT as at July 2015 was 2.4%.

- The average QLD dealer saw an NP%S of 2.1% in July 2015 and calendar YTD NP%S around benchmark levels at 3.4% - both results being the strongest amongst the state groups. While the July 2015 result was 0.2 percentage points above July 2014, the average QLD dealer saw less profitable new car operations between the periods with 9.1% of new car gross profit retained in July 2015 compared to 11.4% in July 2014.

- Average NP%S for the SA/NT state group was 2.0% in July 2015 and 2.5% for the calendar YTD. Despite the region selling less new vehicles in July this year compared to July 2014, the average dealer saw more profitable new car operations.

- The average VIC/TAS dealer returned an average dealer profitability result of 1.5% in July 2015 and 2.1% for the calendar YTD. VIC/TAS dealers continue to maintain their stronger performance in 2015 compared to 2014. While front end performance was below the industry average, the stage group was on average the most profitable in service.

- WA was the least profitable state for the month with an average NP%S figure of 1.2% in July – 0.8 percentage points below the result for the same month last year. Although the recovery of selling expenses of each department has reduced when comparing July 2015 to July 2014, overheads were better controlled between the periods.

Segments

Dealer profitability for both the July month and the calendar YTD in 2015 was higher for all segments when compared to 2014. The luxury segment continues to be the most profitable at 2.7% NP%S for the July year to date, followed by the prestige segment at 2.6% and the volume segment at 2.5%.

Click the chart below for more details.

Dealership data contained in this document has been obtained from the eProfitFocus database. Over 800 dealers across Australia have contributed towards this data.

© 2015 Deloitte Motor Industry Services Pty Ltd

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.