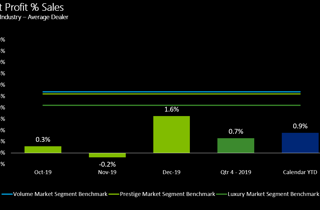

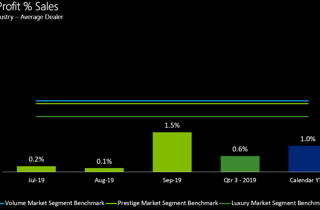

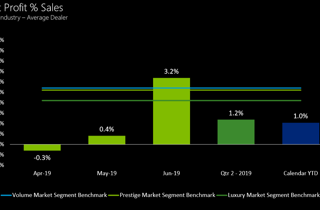

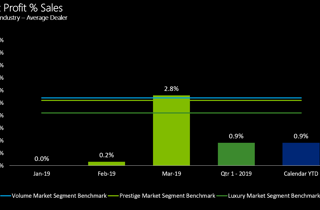

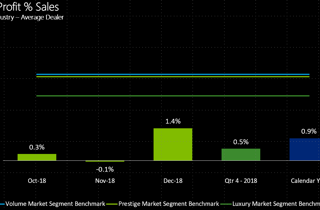

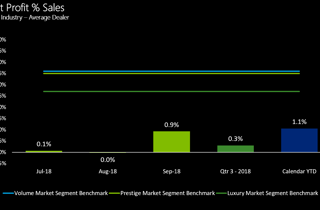

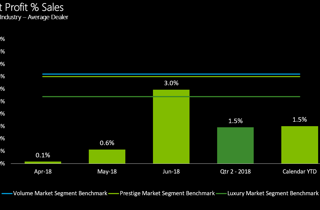

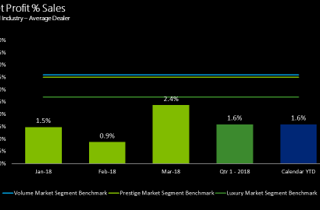

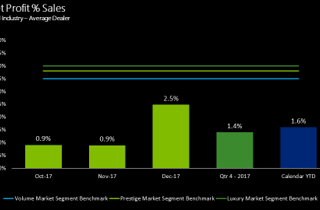

Dealer Profitability

What are the facts on dealer profitability? Drawing on the eProfitFocus database - with over 850 contributing dealers across Australia and New Zealand - we give you the hard numbers every month that reveal the dealer profitability story.

Just click on the reports below.