May 2015 Dealer Profitability

Deloitte Motor Industry Services | 26 June 2015

Total Industry

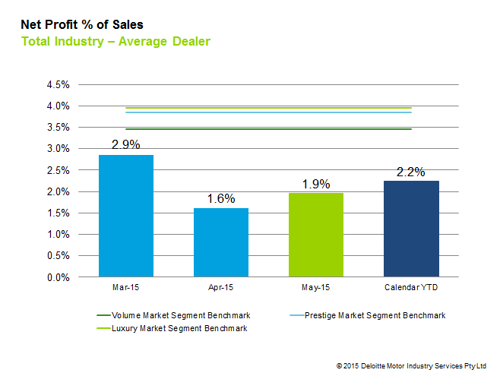

NSW, ACT, QLD , SA & NT all recorded profitability that was on par with, or exceeded both the MTD & YTD national average of 1.9% and 2.2% respectively. These results represented good growth since the drop in April.

State-by-State

NSW, ACT, QLD , SA & NT all recorded profitability that was on par with, or exceeded both the MTD & YTD national average of 1.9% and 2.2% respectively. These results represented good growth since the drop in April.

New South Wales / Australian Capital Territory

Dealer profitability in NSW & ACT was recorded at 1.9% for the month of May. This was up 0.6 percentage points on the April result, and falls just short of the state group’s YTD NP%S of 2.0%. Strong growth in used vehicle sales, without an offsetting

Queensland

QLD recorded the strongest performance, returning NP%S levels of 2.8% for May, driving YTD profitability to 3.1%, exceeding the national average in both measures. While most departments remained relatively stable in their performance when compared with the April result in QLD, the service department made a more significant contribution to dealership profitability in May – with a higher gross margin and selling gross % gross performance from the department.

South Australia/Northern Territory

The average dealer in SA & NT performed in accordance with the national average, reporting a NP%S for May of 1.4%. This fell short of the YTD NP%S for the state group of 2.3%. The parts department in the state group was not as strong a contributor to dealership orientation when compared with April.

Victoria/Tasmania

VIC & TAS have reported a result indifferent to their April profitability at 1.5%. Coupled with YTD NP%S of 1.9%, they fell just short of the national average across the board. However, of note, the average VIC & TAS dealer focussed on cost control this month, with a slight contraction in dollar expenses per new and used vehicle sale.

Western Australia

WA achieved NP%S that was up 0.2 percentage points on April, recorded at 1.1% for the month of May. This drove YTD NP%S for WA to 1.4%. May saw a 5% increase in the contribution of the service department to the average dealership’s total gross profit, while new and used departments contributed slightly less when compared to April.

Segments

The Luxury and Prestige markets returned May NP%S results of 2.3% and 2.2% respectively, stabilising and strengthening their YTD results. The Volume market returned 2.0% in both MTD and YTD NP%S results – with the MTD result being an increase of 0.5 percentage points compared to April.

Click the chart below for more details.

Dealership data contained in this document has been obtained from the eProfitFocus database. Over 800 dealers across Australia have contributed towards this data.

© 2015 Deloitte Motor Industry Services Pty Ltd

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.