2013 Motorcycle and Truck Benchmarks

Deloitte Motor Industry Services | 6 August 2013

Deloitte Motor Industry Services has released the 2013 benchmarks for the Australian motorcycle and truck industries. This is in addition to the 2013 benchmarks for the Australian and New Zealand retail car industries released earlier this year.

For a copy of our 2013 motorcycle benchmarks, click here.

For a copy of our 2013 truck benchmarks, click here.

Motorcycles

Australian Industry Overview

The 2012 calendar year saw slight growth in total new motorcycle sales compared to 2011. Total registrations nevertheless remained below the levels reached in 2007 and 2008.

As at June 2013, total motorcycle sales are 2.4% higher compared to June 2012 on a year-to-date basis. A significant driver of this growth has been sales of Off Road motorcycles. This is the 2nd largest product segment (contributing approximately 32% of total sales) and sales are 10.1% higher on a year-to-date basis compared to June 2012. At the other end, in a sign of changing customer preferences, sales of scooters are down 13.2% on a year-to-date basis compared to June 2012.

Honda MPE remains the largest brand by market share, accounting for 22% of total sales by the industry. In addition to Honda MPE, Kawasaki, KTM, BMW, Harley Davidson and Yamaha have all expanded their sales volumes on a year-to-date basis compared to June 2012. Suzuki sales have contracted 8.6% over the same period, led by a decrease in the ATV and On-Road product segments.

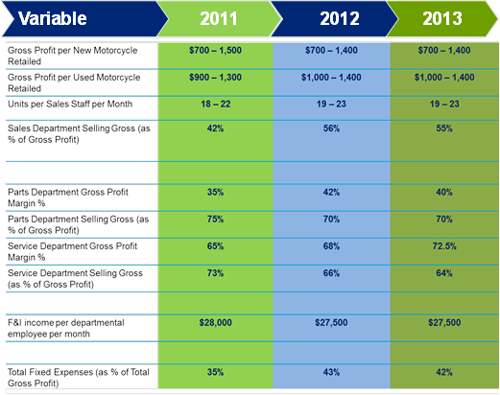

Key Benchmark Movements

Trucks

Australian Industry Overview

Similar to the motorcycle industry, the 2012 calendar year saw slight growth in total new truck sales (classified as heavy commercial vehicles in VFACTS) compared to 2011. Total registrations also remained below the levels reached in 2007 and 2008.

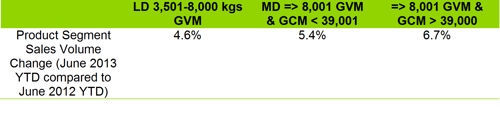

As at June 2013, total truck sales are 5.4% higher compared to June 2012 on a year-to-date basis. As the below table illustrates, all segments have increased total sales volumes on a year-to-date basis:

Trucks within the LD 3,501-8,000 kgs GVM segment are the greatest contributor to overall truck sales in Australia for the year-to-date, providing over 42% of total sales.

Isuzu is the largest brand by market share, accounting for nearly one-in-five truck sales by the industry. Hino, Mitsubishi Fuso and Mercedes-Benz are the only other brands with more than 10% of the overall market share. Within the 10 top selling truck brands, Isuzu is the only brand to see sales volumes contract on a year-to-date basis compared to June 2012. Mitsubishi Fuso, Kenworth and Hino, in particular, are brands that have experienced sales volume growth greater than 6% over this period.

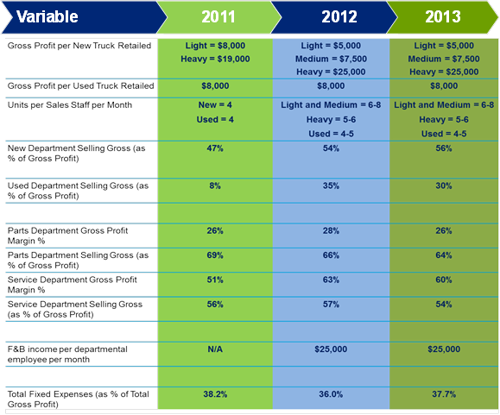

Key Benchmark Movements

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.