Financial Dynamics of Used Cars

Deloitte Motor Industry Services | 4 June 2013

As dealers experience high levels of new retail sales volumes, they are increasingly being presented with used vehicle stock via trade-in arrangements. Whilst the private-to-private market has undoubtably grown over the past decade with the growth of the internet, dealers should consider reclaiming a greater share of the used vehicle market considering its potential rewards.

The Importance of the Used Vehicle Department

The used vehicle department is often viewed as a risky department by the average dealer. This is because the fundamentals of the used vehicle department are very different from the new vehicle department. Further, the dynamics have changed, with customers possessing higher bargaining power and knowledge than ever before.

Despite these challenges, the used vehicle department remains vital to sustained dealer profitability. This is particularly the case as the dealer profitability model continues to evolve. Whilst it does have it’s own unique challenges, the used vehicle department presents an opportunity to proactive dealers. The potential rewards to these dealers who understand and implement the fundamentals are improved departmental profitability, more F&I opportunities, more parts and service opportunities, more aftermarket opportunities as well as the ability to sell more new vehicles.

To capture these opportunities, it is important not to lose sight of the fundamentals of the used vehicle department.

Back to Basics

Profitability in the used vehicle department is reliant upon two fundamental factors:

- Gross profit is achieved in the buying of the used vehicle, not at the sale

- The more current the stock, the greater the gross profit per vehicle

Dealers who achieve these two fundamental factors can expect to:

- produce higher gross profit per unit

- reduce their wholesale losses

- carry stock in higher demand

- reduce “tear ups” from aged stock

Gross profit is achieved in the buying of the used vehicle, not at the sale

Used vehicle department gross profit suffers dramatically for dealers who sell ‘what they trade’ rather than ‘what the customer wants’. As such, it is important for dealers to ‘stock what sells’ in the used vehicle department.

A stocking matrix is useful to understand customer demands. Dealers who use a stocking matrix, reflecting demand and enquiry off the yard as well as broader market trends (which may not necessarily represent sales) usually produce stronger gross profit margins and suffer less stock aging problems. Alternatively, dealers who do not use a stocking matrix and rely on what they think might sell often produce lower grosses and more often have ageing problems.

Trade-in arrangements on new vehicle sales present dealers with much of their used vehicle stock. The importance of accurate and fair costing upon trade-in cannot be overstated. So called ‘overtrading’ often amounts to problems at 90 days of holding the vehicle, when the trade is retailed at a discount or sold at a wholesale price. The holding costs and opportunity costs from aged stock will often give rise to a loss even though the vehicle (at face value) was sold at a ‘profit’. Therefore, it is vital that used vehicle departments ‘buy right’.

Overtrading may be caused by not treating each department as its own profit centre. The new vehicle department should not dictate the profitability and stocking requirements for the used vehicle department. As such, for the used vehicle department to be successful, it needs to cooperate, but not be dictated, by the new vehicle department.

Reducing the time to recondition stock is critical to increasing the return on investment (ROI) and improving profitability from the used vehicle department. In many cases, a key success factor towards this objective is a reconditioning department separate from the service department. It requires a different mindset and skills to recondition a used vehicle as opposed to carrying out more regular services.

The more current the stock, the greater the gross profit per vehicle

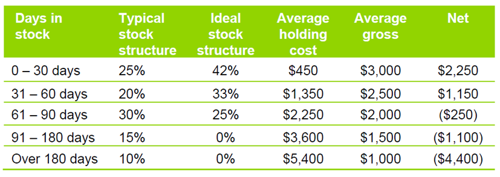

Using data collected from our ProfitFocus database over the past three years, it is evident that from the date of purchase the gross profit margin achieved on a used vehicle sale declines on a daily basis. At 90 days of holding, the gross profit is shown to be only one-third of the available gross profit as at day 1.

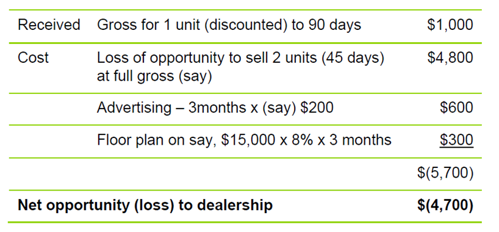

The below is an example of the true cost of aged inventory when the opportunity cost is factored into the equation:

Maybe this vehicle should not have been traded or purchased in the first place. We have all heard the tale of the 90 day use vehicle sold for $5,000 gross profit, but it is fairly unrealistic to assume that this will happen every single time.

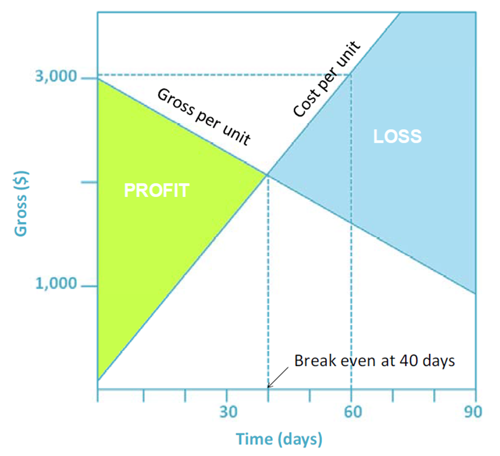

Our data has further shown that it costs the average dealer approximately $27 per day to stock and advertise a single used vehicle. This shows that even if opportunity costs are ignored and only traditional direct costs, such as advertising and floorplan, are included, the gross profit margin per unit falls until the breakeven point is reached at 40 days. After 40 days an increasingly large loss continues to be incurred.

It is interesting to note that even if the day 1 full gross profit margin is achieved at 60 days the accumulated holding costs will have already equalled the gross profit margin. From that point on, a loss will be made in spite of making a full gross profit margin.

As the below graph demonstrates, the key point is that the longer the car stays in stock the higher the real costs become and the greater is the likelihood of making a loss:

Total used vehicle department gross profit is maximised when strict wholesale policies and dynamic pricing are adopted.

Strict wholesale policies work

The cost of owning up to a purchasing mistake can be an expensive proposition. This can be an inhibiting factor in policing a strict wholesaling policy on aged inventory.

Whilst it is always better to retail trade-in stock rather than wholesale, there is no point in delaying the inevitable. Adherence to a strict wholesaling discipline will is needed to produce the best results.

An example of an effective wholesaling policy may be:

As the below will demonstrate, there is a strong correlation between days supply and used vehicle department profitability.

Dynamic Pricing

Today more than 80% of all used vehicle sales start on the internet. The internet has turned the used vehicle market from an inelastic market into an near-perfectly elastic market. Previously, due to a lack of price transparency between the dealer and the customer, the price of used vehicles would not correlate with the open market. Nowdays, however, a customer is able to source the best price for their trade-in or purchase within 10 minutes on the internet. This has made the need for dealers to continually update their pricing in a minimum of 7 day intervals critical and reference this pricing to current internet pricing. This is called ‘dynamic pricing’.

To illustrate, below is a table comparing two traditional used vehicle dealers to a used vehicle “super store” which has adopted a variety of dynamic pricing and the difference in pricing to the current market:

As the above demonstrates, the “super store” is ‘pricing to sell’. This model of dealer has also been termed a ‘velocity’ dealer as it focuses on quick and constant turnover, and, as such, total departmental return on investment (ROI) rather than gross profit per unit.

If you extrapolate this to an individual holding cost and gross profit margin over time, the financial impact over time of not having a dynamic pricing model in your used vehicle department can be seen:

It is important that dealers stay the course when implementing a dynamic pricing model. They must ensure that the department is geared to allow such change and that this model be supported by a dedicated full-time used vehicle department manager and a commitment from the broader dealership to becoming an attractive used vehicle destination.

The Bottom Line

The used vehicle department is the single department that dealers truly control. Financial success in the used vehicle department over the long term relies on having a few fundamental disciplines in place and avoiding being viewed as a secondary, support department rather than a profit centre. Dealers who apply these fundamental disciplines and vision, as well as train and manage their used vehicle staff via aligned commission schemes to drive productivity, will ultimately capture these opportunities and reap the rewards.

General Information Only

This presentation contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively the “Deloitte Network”) is, by means of this presentation , rendering professional advice or services.

Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss whatsoever sustained by any person who relies on this presentation.

About Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities, which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more.

Deloitte Asia Pacific Limited is a company limited by guarantee and a member firm of DTTL. Members of Deloitte Asia Pacific Limited and their related entities, each of which are separate and independent legal entities, provide services from more than 100 cities across the region, including Auckland, Bangkok, Beijing, Hanoi, Hong Kong, Jakarta, Kuala Lumpur, Manila, Melbourne, Osaka, Seoul, Shanghai, Singapore, Sydney, Taipei and Tokyo.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser.

No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities.